Roadside Assistance

Roadside Assistance |

Elephant offers emergency towing and roadside assistance to our customers as an inexpensive and reliable coverage on our auto policies.

Contact Numbers: (877) 321-9910

- Available 24/7/365 from wherever you are

- Real-time tracking of your service provider’s progress toward you. You’ll see their name and the information about their service vehicle.

- Keep others in the loop. Share your service-tracking link with family, friends, or coworkers to give them continuous live updates about your status.

If purchased, roadside assistance is available for use when your vehicle becomes disabled due to a covered emergency. In this case, a covered emergency is one that is a result of:

- a mechanical or electrical breakdown

- battery failure

- insufficient supply of fuel, oil, water, etc.

- flat tire

- lock-out

- entrapment in snow, mud, water, or sand

What does Roadside Assistance Cover?

- Towing

- Vehicles will be towed up to the maximum benefit limit to the nearest qualified repair shop.

- Battery Jump Start

- Agero will arrange for a service provider to attempt to start the customer’s vehicle. If it can’t be started, Agero will arrange for a towing based on the towing limit.

- Flat Tire Change

- Agero will arrange for a service provider to change flat tire with an inflated spare. If the customer does not have a spare, Agero will arrange for towing based on towing limit.

- Lock Out Service

- If a customer’s car door key is lost, broken or accidentally locked inside of the car, Agero will arrange to send a service provider to open the vehicle's door. The making of a spare key is not included.

- Fuel Delivery

- Agero will arrange for a service provider to deliver up to 2 gallons of gasoline or diesel fuel. The customer must pay for the fuel when it is delivered.

- Winching

- If a vehicle is in a ditch or stuck and accessible within 100 feet from a normally traveled roadway and conditions allow for the vehicle to be dislodged if stuck, dispatch coverage for winching is provided.

Roadside assistance benefits are limited to 3 uses per vehicle each year in all states except Virginia. Once the limit has been reached, customers can pay for assistance out-of-pocket at a reduced rate. In VA, each service is unlimited (do not advise your customer of the unlimited usage or use as a selling point).

When advising of ERS, make sure to advise of the correct state limits. Say that we cover "up to $75.00" or "up to 15 miles."

It is important to note that ERS coverage is not retroactive and does not cover pre-existing conditions.

Coverage limits by state

| Service | All Other States | VA |

| Towing | Up to 15 Miles ($7.50 a mile after limit) | Up to $75 ($7.50 a mile after limit, paid by customer that day)** |

| Battery Jump Start | Up to $75 | Up to $75 |

| Flat Tire Change | Up to $75 | Up to $75 |

| Fuel Delivery | 2 gal (fuel paid for by customer) | 2 gal (fuel paid for by customer) |

| Lock Out Services | Up to $75 | Up to $75 |

| Winching | Up to $75 | Up to $75 |

| Uses Per Year | 3 uses per vehicle per year* | Unlimited (Do not proactively offer this information.) |

*Per year regardless of term length. Once the limit has been reached, customers can pay out-of-pocket at a reduced rate.

**If the customer wants their vehicle towed further than the limit, Agero will be able to quote the price in advance so that the customer knows what they will be paying before the tow occurs

NOTE: After exceeding the $75 tow limit in VA, the cost per mile can vary by mileage:

Rate Tier | Rate |

<25 miles | $7.50 |

25-50 miles | $10.00 |

50+ miles | $10.50 |

Rental Reimbursement

Rental Reimbursement |

Rental Reimbursement is a first-party coverage that is available when your covered vehicle is not drivable or needs repairs following a comprehensive or collision claim. If selected as a policy coverage, rental reimbursement will provide you with a rental vehicle while your vehicle is being repaired or replaced. Again, this coverage is only available following a covered claim. Policy limits and exclusions apply.

All states except Virginia have a per day limit, with a maximum total amount that will be paid for the claim. Virginia only specifies a maximum coverage and does not have a per day limit. The following chart shows the available limits by state:

| State | Per Day | Maximums |

| GA, IL, IN, OH, TN, TX | $30/$40/$50 | $900/$1200/$1500 |

| MD | $30/$40/$50/$100 | $900/$1200/$1500/$1500 |

| VA | N/A | $600/$900/$1200 |

When obtaining a rental vehicle, you are responsible for the initial deposit, which is refundable, as well as the damage waiver, any additional gas needed, or insurance purchased. We work directly with Hertz, so you do not have to pay for your rental limits up front. If you choose to go with another rental company, you would pay up front, then the adjuster would review for the appropriate reimbursement.

Diminishing Deductible

Diminishing Deductible |

Diminishing deductible is a coverage feature that can be added onto a vehicle's collision deductible to lower the out-of-pocket costs in the event of an accident*. To be eligible, all vehicles with collision added must have at least a $500 deductible. It is an all or none coverage, so all vehicles on the policy with collision must opt for the coverage (vehicles with liability-only are exempt).

With the coverage selected, customers will see an immediate reduction of their deductible amount by $100 for yearly policies or $50 for 6-month policies. The deductible will reduce automatically after the policy is bound and will continue to reduce by $100 (for yearly policies) or $50 (for 6-month policies) each term the customer remains accident-free*.

The maximum amount the customer's deductible could reduce by is $500.

Example: A customer purchases a 6-month policy with a $1000 collision deductible with diminishing deductible added. Immediately, the customer's collision deductible reduces to $950. If the customer remains accident free for the foreseeable future, their collision deductible will reduce by $50/term until it reaches $500. Having reached the maximum reduction amount, the deductible will freeze at $500.

On the other hand, a customer who chooses a $500 collision deductible, for example, could have their collision deductible reduce all the way to $0, if they remain accident free!

In the event of an accident*, the customer will not see a reduction in their deductible at renewal. Instead, it will remain the same (freeze) for one term and will continue to decrease following the next accident-free* term. It does not reset!

*DD is affected by chargeable and non-chargeable accidents. When talking to your customer, keep the description simple by saying "accident-free."

Example: A customer purchases a 6-month policy with a $500 collision deductible with diminishing deductible added. Immediately, the customer's collision deductible reduces to $450. The customer has an accident during their first term. At renewal, their collision deductible freezes at $450. It will continue to reduce following an accident-free term.

The cost for this coverage is $30/term/vehicle for 6-month policies ($60 a year). It can only be added at new business and renewal. It cannot be added mid-term.

To add this coverage you will go to the quote page where you select coverages. Diminishing Deductible is found under Additional Benefits.

Legal Assistance

Legal Assistance |

We partner with Legal Resources to provide a coverage plan that offers:

- 100% free attorney fee coverage once per year for a minor traffic violation, such as a speeding ticket (including reckless tickets!).

- A 25% discount on other legal services, including:

- Legal consultation and advice

- Will preparation

- Real estate transactions

- Reviewing and preparing legal documents

- Divorce

When legal assistance is purchased, every driver on the policy will have access to the once per year attorney fee coverage for a minor traffic violation and the other discounted services.

Legal assistance is available in all states except Illinois. For a single driver on the policy, the cost will be the "individual" cost. Multiple drivers will receive the "family" cost.

- Georgia, Indiana, Maryland, Ohio, & Virginia: $5 individual/month; $8 family/month ($60/$96 annually)

- Texas & Tennessee: $6 individual/month; $9 family/month ($72/$108 annually)

- Illinois: Unavailable; we don't have the license necessary to sell Legal Resources coverage in IL.

For customer inquires about using the coverage, please direct customers to Legal Resources (1-800-728-5768).

Check out the Legal Resources Website HERE.

Loan/Lease

Loan/Lease |

-

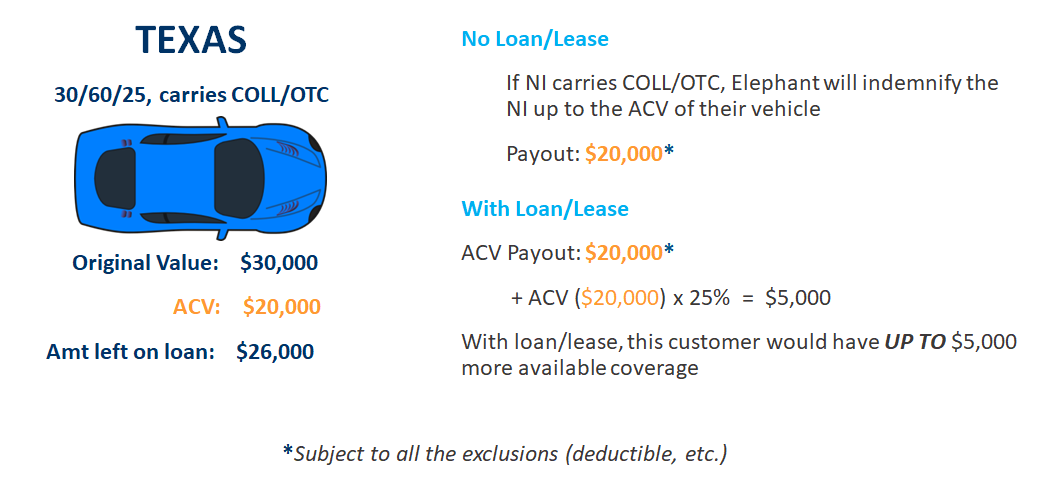

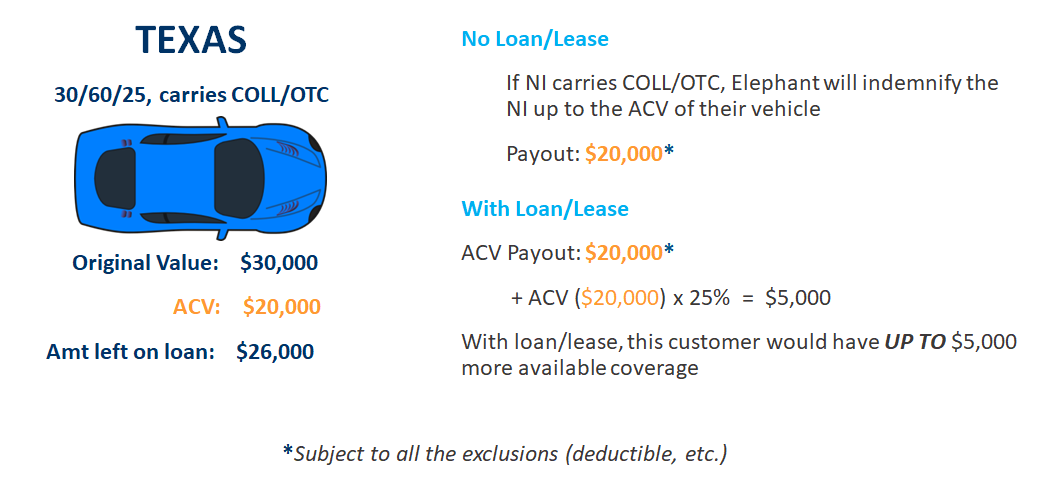

Elephant does NOT offer Gap insurance! Loan/Lease coverage is NOT Gap coverage.

If your car is totaled and you are “upside down” (owe more than the value of the car) on your loan, then loan/lease coverage can help offset the remaining amount due on the loan/lease. Loan/lease will not pay for:

- Your comprehensive or collision deductible

- Any overdue loan/lease payments at the time of the loss

- Financial penalties imposed for: excessive loss, abnormal wear & tear, or high mileage

- Security deposits not refunded by a lessor

- Cost of extended warranties, credit life, health, accident, or disabilities

- Carry over balances from other loans

- Cost of service contracts

Loan/lease only applies if your vehicle is a total loss. The vehicle must have comprehensive and collision coverage to be eligible.

Loan/Lease Payoff Limit of Liability GA up to 25% of the ACV of the vehicle towards the unpaid amount due on the loan/lease* IN up to 25% of the ACV of the vehicle towards the unpaid amount due on the loan/lease* IL up to 25% of the ACV of the vehicle towards the unpaid amount due on the loan/lease* MD up to 25% of the ACV of the vehicle towards the unpaid amount due on the loan/lease* OH up to 25% of the ACV of the vehicle towards the unpaid amount due on the loan/lease* TN up to 25% of the ACV of the vehicle towards the unpaid amount due on the loan/lease* TX up to 25% of the ACV of the vehicle towards the unpaid amount due on the loan/lease* VA unpaid amount due on the loan/lease* *policy contract exclusions apply

There is no limit specified for VA’s coverage, but in our other states, we will only pay up to 25% of the actual cash value of the auto toward the remaining balance on the loan/lease. In Virginia, loan/lease payoff is only available for vehicles that are 8 years old or younger.

Here is an example of how loan/lease payoff could help offset the remaining balance due on the loan. Keep in mind that exclusions do apply and every claim is different.

Accident Forgiveness

Accident Forgiveness |

Accident forgiveness is a policy feature that is automatically earned after a customer goes three consecutive years without having an accident on their policy (no accidents for any driver on the policy). After remaining accident free for 3 years, the customer is eligible to have their next at-fault accident waived from their policy. A waived accident will not affect the premium with an accident surcharge, but will freeze diminishing deductible, if applied to the policy.

Only one accident is eligible to be waived per policy. Once an accident is waived, it stays waived until it falls off after 3 years.

Example: Customer starts their 6-month policy with us and goes accident free for 3 years. A driver on their policy has an at-fault accident during their 7th term. The accident is waived from their policy at the renewal of their 8th term and stays waived for 3 years before it falls off the record.

(accident is abbreviated as "AX")

Upgraded Accident Forgiveness (UAF)

Upgraded Accident Forgiveness (UAF) |

Eligibility

- If they qualify, customers can now purchase Upgraded Accident Forgiveness (UAF).

- To be eligible, there cannot be any chargeable or non-chargeable accidents from the past 3 years for any driver on the policy.

- It will ONLY appear if the customer is eligible.

How does it work?

At renewal, PC will automatically check claims history for the prior term. If there was a chargeable or non-chargeable accident, it will be waived.

If there are multiple accidents, the most severe accident will be waived.

When can it be added?

It can only be added at new business and renewal. However, we can add UAF regardless of other coverage options (ex: comp and collision).

UAF can be removed at any time.

Pet Injury

Pet Injury |

Pet Injury Protection is automatically included in every policy at no additional cost. This is for all states. If your dog/cat (or a family member's dog/cat) is injured as a result of a covered* auto loss, we will provide:

Pet Injury Protection is automatically included in every policy at no additional cost. This is for all states. If your dog/cat (or a family member's dog/cat) is injured as a result of a covered* auto loss, we will provide:

- Up to $1000 for reasonable and customary vet fees

- A $1000 death benefit if your pet dies in, or as a result of, the covered loss

*In order for this feature to apply, your vehicle would have to be covered by the claim (Think: collision, comprehensive, UM/UIM). This would not apply under a liability-only claim. The concept is very similar to rental reimbursement where the customer can only get a rental for a covered loss – Pet Injury Protection will only apply if the customer’s vehicle is being covered by us AND the pet was injured as a result of that covered claim.

Suggested scripting:

Just so you know, at no cost to you, your policy comes with Pet Injury Protection that will help pay if your cat/dog is ever injured in a covered loss.

Here at Elephant, we also care about our customers’ cats and dogs, so if your pet was ever injured in a covered claim, you have up to $1000 of Pet Injury Protection at no cost to you.

Elephant also automatically includes up to $1000 of Pet Injury Protection free with every policy. This can help with vet fees if your pet gets injured during a covered claim.

Pet Injury Coverage Endorsement Language

Glass Deductible

Glass Deductible (Covered under Comprehensive) |

There is no separate glass coverage at Elephant. Glass is covered under Other than Collision coverage (aka Comprehensive). If the window is damaged under a covered claim and the window is able to be repaired, there is no deductible. If the window has to be replaced, the deductible will have to be met. Whenever discussing coverage, we do not want to say specifically what is and isn't covered as it is circumstantial.

Custom Parts and Equipment

Custom Parts and Equipment |

Elephant CPE Limits

Each state has an allowable limit for custom equipment. If a vehicle has more than that amount of custom equipment, it would be an unacceptable risk. You could offer Answer Financial. This table outlines the state specifics regarding custom equipment:

State | Up to $1000 automatically covered? | Can more CPE coverage be purchased? | Unacceptable Risk |

|---|---|---|---|

Georgia | Yes | Yes, up to $20K | over $20K |

Illinois | Yes | Yes, up to $20K | over $20K |

Indiana | Yes | Yes, up to $20K | over $20K |

Maryland | Yes | Yes, up to $20K | over $20K |

Ohio | Yes | Yes, up to $20K | over $20K |

Tennessee | Yes | Yes, up to $20K | over $20K |

Texas | Yes | Yes, up to $20K | over $20K |

Virginia | Yes - Up to $1,500 | No, coverage not available for $1,501-$5K | over $5k |

How to Add CPE Coverage

The custom equipment field on the Vehicles page is an Underwriting question designed to discover unacceptable risks. The selection made on this page does not transfer to the quote page.

This does NOT apply any coverage. (UW question only) |  |

In order for a customer to have custom equipment coverage, their car would need to be covered by comprehensive and collision coverage, and the selection would need to be made on the Quote page.

| This applies coverage! |  |

Virginia

In Virginia, custom parts and equipment on a customer’s vehicle are covered underneath comprehensive and collision up to $1,500 – there is no additional coverage for customizations available. If a customer has $1,501 to $5,000 of CPE and they want it covered, refer to partner carriers since VA does not have additional CPE coverage. If a customer has more than $5,000 worth of customizations on the vehicle, and you fail to ask for customizations, this may put Elephant on the hook to cover more than we would normally cover.

All Other States

In all of our other states, the customer has the option to purchase a separate coverage for their custom equipment. Elephant will cover up to the first $1,000 of custom parts at no cost to the customer. The customer would need to elect first-party coverages on their vehicle (comprehensive & collision) in order to add on additional custom equipment coverage.

Lift Kits

Vehicles with lift kits higher than 4 inches are unacceptable.