Overview

Overview |

If the named insured or any driver on the policy has an International License, it will block their portal access.

The Online Portal and App is a great way for customers to view their information and to manage their auto insurance policy entirely online. The portal can be accessed by logging into our website, and the App can be downloaded on GooglePlay and the App Store.

Error when attempting to log into the portal/app

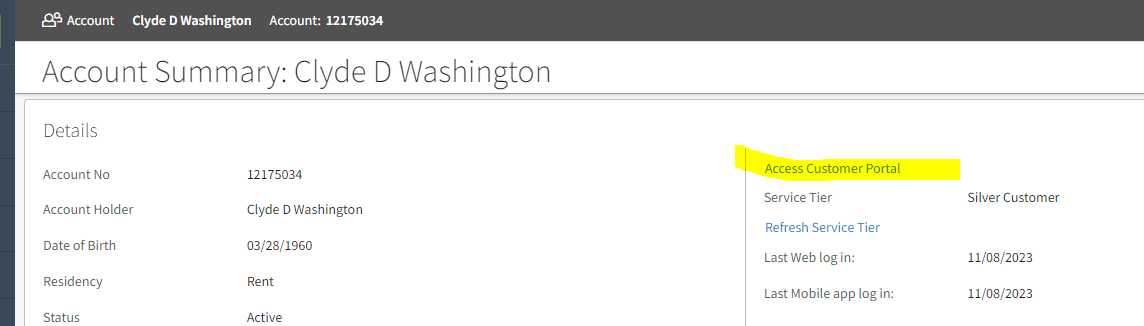

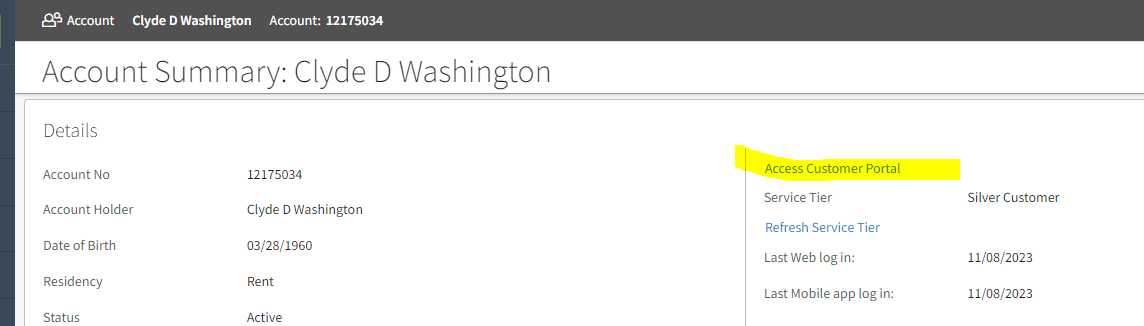

- Use the portal mirror in PC to determine if we get an error on our side first.

- If you do not get an error and have full visibility, confirm the email the PH is using to attempt to log in. Make sure it matches the email in PC.

- Confirm the type of error “log in is invalid or password is invalid”. If the password is invalid, suggest the reset password option first.

- If the login is invalid, reconfirm the email and then partner with Leadership to look in admin to determine if there is a data issue preventing a login.

- If you do get an error when attempting to view the portal, partner with Leadership immediately so we can pinpoint the issue. In most instances, the PH never registered. In other instances, there might be duplicates or missing info which prevents the PH from logging in.

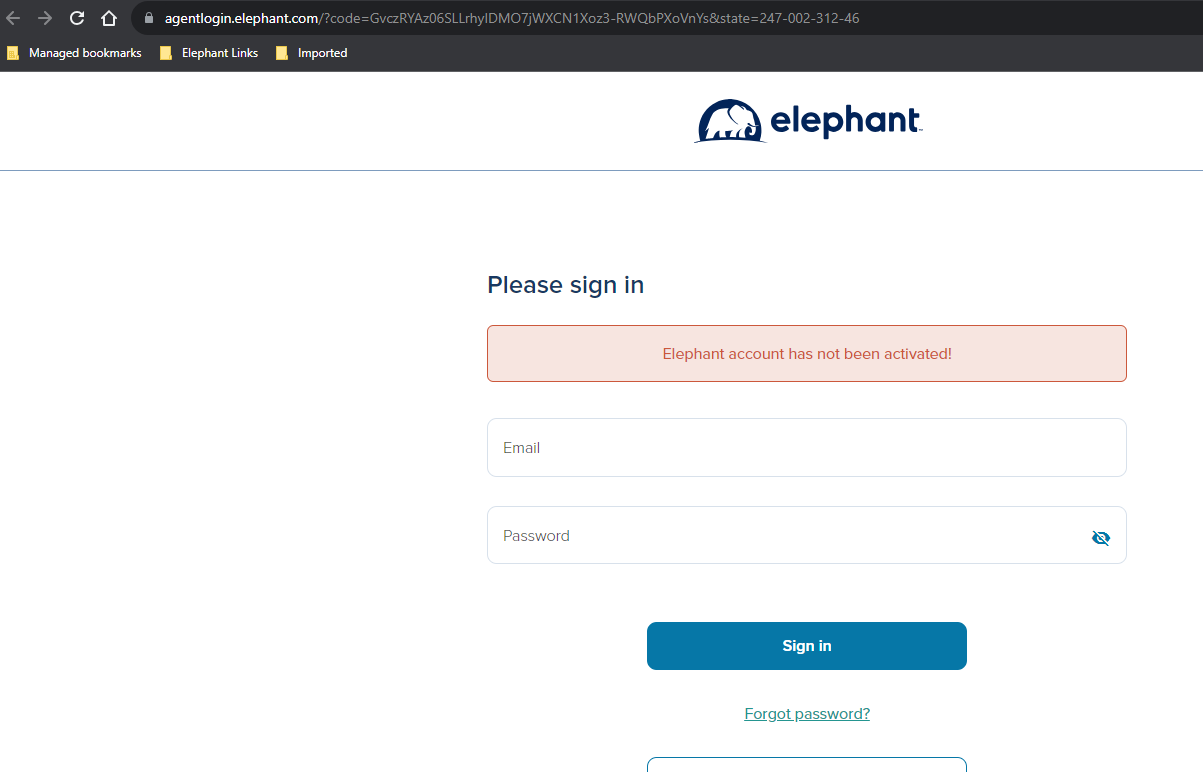

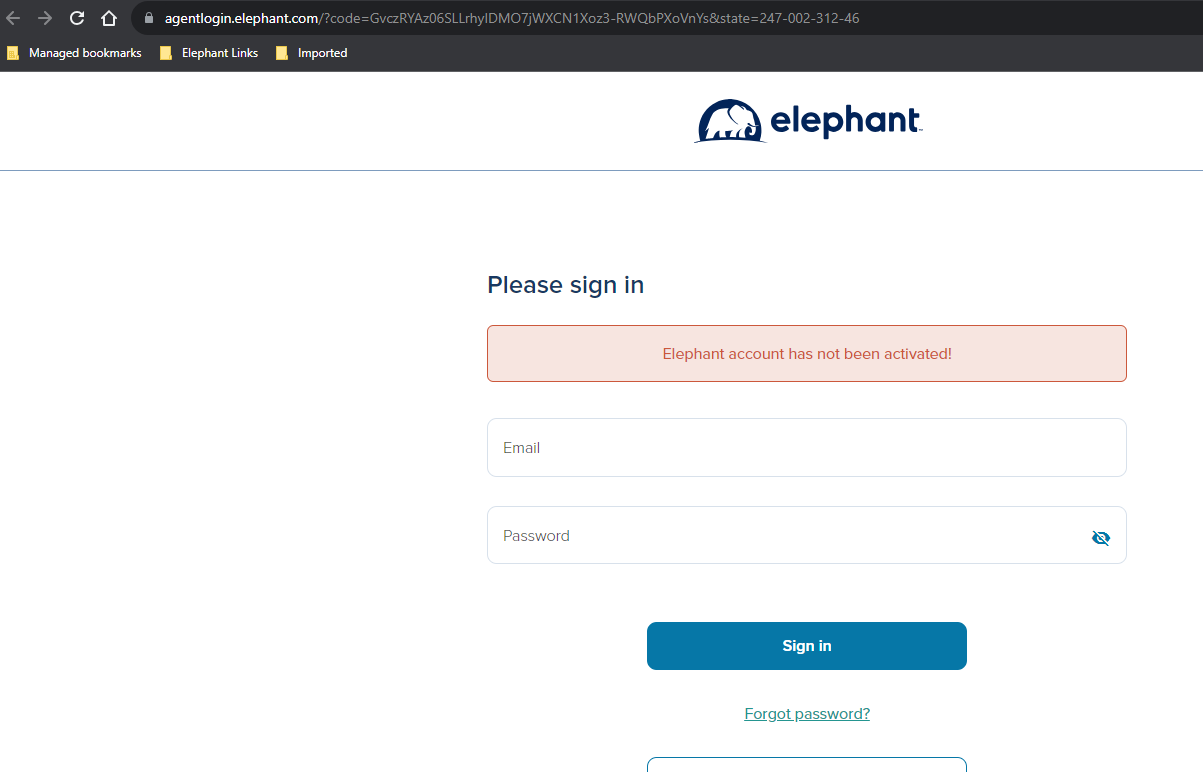

Portal never activated

PH reporting getting an error when attempting to register for the portal.

The fastest way to figure out if this is a user issue is to attempt to register to see if you can get to the “request authorization code” page. Below is an example. We should never complete set up for the customer but if we can get to this page and they can’t, there is probably a data issue that we missed or a user error when the customer is attempting to register.

- Verify the spelling of the last name.

- Confirm DOB is correct in both places in PC (Account Level summary page and driver page) and confirm the zip code.

- Advise that they must use the last name of the NI on the policy (if it is a spouse calling in).

Online access says cancelled or outdated information

If a policyholder is cancelled, they can still access the portal infinitely to make payments, but no other changes can be made.

If they got a new policy and it still says cancelled on the portal, we need to remove the email association with the old policy number.

- From the policy level in PolicyCenter, select "Actions" → "Change Policy"

- Advise of Effective Date (Same Day) the next day and select Other Change (No Premium Impact)

- On the Applicant tab, select "Yes" to "Remove Existing Policy Association with Email"

- Quote and Bind policy change.

- Advise that they may have to reset password.

- If there is still an issue after completing this update, the customer may have more than one profile. Use InfoSearch to search by name to determine if the PH had a previous account:

What can be done on the Portal & App?

Portal vs. Mobile App |

Updates will be made to this chart over time.

| Key | |

| Available Feature | |

| Unavailable | |

| Will be added in a future release | |

| Feature | Portal | Mobile App | Notes |

| Multi-factor authentication | |||

| Biometrics (Face ID) | |||

| Offline ID Cards | |||

| Forgot/Reset password | Link to reset password email | ||

| Update Email | |||

| Opt into SMS | |||

| Update Phone Number | |||

| Change garaging/mailing address | Can now be done on App! | ||

| Account deletion | Link to call Customer Care | ||

| Update account/email association (from prior cancelled policy) | Need to chat or call to do. If a new policy is started it will automatically be disassociated. | ||

| Download/fax/email ID cards + policy docs | |||

| Upload policy or UW documents | Needs to be emailed to Care/UW | ||

| View UW Documents | *Banner will be shown UW needs something. | ||

| Request POC or LOE | |||

| Add ID cards to Apple/Google Wallet | ID cards can be saved to Apple + Google Wallets from the app. | ||

| Process a Payment and Download the Receipt | Receipts can be downloaded on the portal in the payments section. | ||

| Reschedule a Payment | |||

| Add/update a new card or ACH/EFT | |||

| Switch to Bill Me | Need to chat or call in | ||

| Scan to add credit/debit card | |||

| One-time use card (without saving to account) | |||

| Apple/Google Pay | |||

| Call Emergency Roadside | Link to call ERS | ||

| Track ERS Status | |||

| Add/Change/Remove Coverage | |||

| Add/Replace Vehicle | |||

| Remove Vehicle | |||

| Add Driver | |||

| Remove Driver | Need to chat or call in | ||

| Add/Update Lienholder | Can now be done on App! | ||

| Sign Waivers (PIP/UM) | |||

| Add/Update/Remove financial responsibility (SR22, FR44, FR19) | Need to chat or call in | ||

| Cancel Policy | Need to chat or call in | ||

| Reinstate recently cancelled policy (within the grace period) | |||

| Reactivate cancelled policy (rewrite new term) | Need to call in | ||

| View saved quote draft | |||

| Chat | |||

| File a new claim (ENOL) | |||

| View active claims | |||

| Enter Claims Portal (use current features) | |||

| Same Day Changes | New as of 1/9/2025 |

Claims Portal

Claims Portal |

Policyholders may now manage their claims online! The following services will be available:

- Send and receive notes/documents

- Adjusters will receive an activity notifying when customers send them notes or upload documents

- View claim status

- View relevant adjusters

- View Payments

Click here to view how the claims portal looks!

Password Resets

Password Resets |

When customers need to reset their passwords on the portal, we require the email associated with the policy and the policyholder's date of birth. Passwords must be at least 8 characters and include one lowercase letter, uppercase letter and digit.

| The customer may just see the email field:  |

Portal Walkthrough Screenshots

Portal Walkthrough Screenshots |

Adding a Driver

Once the customer logs into their portal they will land on their home page:

The customer will need to scroll down to where it says "Drivers" on the right-hand side

This will show all the drivers on the policy:

Once they click on "Add Driver" they will put in the driver information

It will then ask the customer if they would like to add a vehicle as well, if they are just adding a driver they would just push "Continue"

They will then need to do the driver assignments:

Once the customer selects "Update Quote" they will then see a screen with the change in premium:

Once the customer reviews everything and is ready to make the change, they just need to select "Change Policy"

They will get this message to let them know the changes have been saved:

Adding and Replacing a Vehicle

The customer will need to scroll down on the bottom right side till they see "Vehicles"

The customer will need to put in the Vehicle details:

If the customer wants to remove the existing vehicle and replace it with a new one they would select "Yes" and then will be prompted with this screen:

If the customer just wants to add an additional vehicle they would just select "No" and will be prompted with this screen:

Once they have filled in all the information they will click "Continue to quote"

The customer will be asked if they want to add another driver and then need to do the vehicle assignment:

The customer will then need to select the vehicle coverage and then hit "Update Quote"

The customer will then see a preview of upcoming billing, if they are ok with the changes they would select "change policy"

Adding/Changing Coverage

On the right top side, there will be an option to "Edit Coverages"

The customer has the option to edit Policy level coverages and vehicle coverages:

Once the customer has selected their coverages, they would select "update quote" this will show them a preview of billing changes:

If the customer is ready to make changes they will select "Change Policy"

Removing Coverage that generates a waiver

When a customer elects to remove a coverage that generates a waiver document, this new feature prompts customers to review and sign that waiver on the Payment page of the CSP/Portal BEFORE processing the change.

This function is only

Making Payments/Update Payment Method

Once the customer is logged into the portal they will select "Manage Payments"

The customer will then be directed to the payments screen. As of 09/06/2023, this is located on a separate tab.

Here they can make a one-time payment, update the payment method and see recent payments:

If the customer is just looking to make a payment, they will select "One-Time Payment" This will show them the amount due and if they want to make a partial payment they can click "other amount"

Once the customer selects the payment amount they will review the payment and payment method, they can also use a different payment method here:

If the customer would like to add this payment method on file they will select "yes" If the customer wants to make this their primary payment method, they need to check the box "Make this my primary method"

It is important to know that the payment is NOT finalized until the customer selects "Correct! Make Payment"

If the customer is entering ACH information for the first time on file, we have a new validation system in place to ensure the account matches what the customer gave us. If the ACH was not entered correctly, or for some other reason cannot be validate at the moment, the customer will see an error message like the one below:

This appears before the "Almost Done" page

The customer will know they have made a payment once they see this screen:

Postponing Payments

Once the customer is logged into their portal they can view and manage payments by selecting the Payments tab:

If the customer selects "Reschedule", this will show the dates they can schedule their payment to draft. Any grayed-out dates are not eligible.

Please remember the payment needs to be at least 48 hours in advance; they can not reschedule payment for the next day:

If the customer selects a date two days or more past the due date they will see a message:

Once the customer has selected the date to reschedule their payment it is NOT complete until they hit "Correct! Make Payment"

The customer will see this page once their payment has been rescheduled:

Downloading Payment Receipts/Confirmation

Sending Policy Documents

A customer also has the ability to download and print email, or fax documents via the portal. Once the customer is logged into their portal if they go under their documents, and click the share button, they can download, email or fax over that document:

If the customer selects email they will see a box to put into the email address:

If the customer selects fax they will see a box to put in the fax number:

They can do this with all their documents:

Updating the Lienholder

Once the customer is logged into their portal, they can view their vehicles listed on the Policy tab.

They can select the individual vehicle to view coverages and lienholder information.

If they click "Edit" under the lienholder box, they can edit their lienholder information:

If the lienholder information does not populate in the system, the customer will be prompted to put in the lienholder's address. Once this is done they can click "Save Lienholder"

Updating Personal Information

The customer can update their contact details including their address:

The customer will then be re-directed to this page where they can choose what information they need to update:

Once the customer makes any changes they need to make sure to save the information.

Mobile App Walkthroughs

Mobile App Walkthroughs |

Getting the Mobile App

If a customer asks about the app, can we tell them about it?

Yes! We can proactively tell them about the Elephant app and that it’s available in App Store/Google Play to download.

Can we email or text customers a link to the app?

Not at this time, but that functionality will be added in a future phase of the app.

How many people can be logged in at once?

The app will really be geared towards the Named Insured however, anyone who has been given permission, provided with the email/login credentials from the NI, and pass the multi-factor authentication can use the app on a different device all at the same time. It is the same for the online portal and app.

New Account Activation

New policyholders who have yet to activate their web portal account can register via the app login.

Activate Account Will show as a button for new users.

For returning users it will appear as a link under Roadside Assistance and View ID Cards

Login

Once they have set up an account they can log in to the app and set up Face ID if they want to:

If the customer does not want to use FaceID they can just sign in and get a code sent to them and choose "remember me on this device"

For each new device, once every 6 months, and once at renewal, the customer will need to verify their identity through Multi-Factor Authentication. They can select either text or email to get a one-time authorization code.

What happens if the customer forgets their password or login credentials?

It will work the same as the portal. The customer will need to click “Forgot password?” on the login screen and they will be prompted to enter the email (their user ID) associated with their account to be emailed a password reset link. They just need to follow the instructions in their email to reset and they will be able to log in with their updated password. Face ID will need to be reconfigured after the reset.

Anytime the customer resets or changes their password, biometrics/Face ID for the account will need to be reconfigured.

Can they reset their password in the app? What does that look like?

They sure can! It will work similarly to the portal. The user will need to navigate to their account info under profile settings (person icon in the top right of the home screen). After selecting “update password” the user is shown a button to be sent a link via email to reset and/or change their password. It is important to note that Face ID will need to be reconfigured after a password reset.

Call ERS

Customers will have the ability to call ERS from the mobile app by clicking on Roadside Assistance and the number will pop up for them to call.

View Offline ID Cards

The customer will have the ability to view their ID cards without logging into the app.

Will customers be able to add their ID cards to their Apple/Google Wallet on their devices?

Yes, Apple and Google Pay are integrated with the app. When documents are downloaded, the phone will ask where you want to store them.

Home Screen

Once the customer is logged into the app this is the home screen they will see with their information:

Their home screen will also let them know about any past-due payments, and if their card is about to expire:

Documents

The customer will be able to save ID cards offline from this screen and also be able to download, email, or fax a document:

Opt-in to SMS/Account Deletion

The customer will have the ability to sign up or edit text alerts:

Account Deletion

If the customer would like to delete their account they will get a message and need to call in.

You will need to put in a ticket for the customer

Please use the "report an issue with the Elephant Mobile App" ticket in solar winds under the Digital category to put in a request to delete the customer's online account details. In the ticket, please include "Delete Customer Login Credentials Request" along with the customer's account and policy number.

Make a one-time payment

Add a New Bank Account (ACH/EFT)

Add a New Credit/Debit Card

Adding a card with Scan Feature:

Adding a card without Scan Feature:

If the customer would update the new payment method for Auto-Pay they can do so by toggling the button to "yes":

Updating Primary Payment Method

Only payment methods showing under "Saved Cards" can be updated or removed.

If the customer toggles "yes" to auto-pay the payment script will populate:

Remove a Payment Method

Reschedule Upcoming Auto-Payment

Past Due Payments

Viewing Vehicle-Level Coverages

Add/Edit/Remove Coverage

Once the customer sees this message, they have successfully made changes to their coverage:

File a Claim

View Open Claims

View Closed and Past Claims

Add Vehicle

Swap a Vehicle

Remove a Vehicle

Adding a Driver

Updating Contact Information

1) The customer will click on the person icon to update this information:

2) They will be able to update their email, change their password, or edit their phone number. If the customer needs to update driver details they will need to call in.

App FAQs

App FAQs |

If the customer mentions an app issue on a call or is experiencing a system issue, where should this information be directed?

You can email us at customercare@elephant.com. This will help our team keep track of and quickly investigate any technical difficulties or system issues with the app.

If a customer returns to elephant, do they need to do anything different in the app?

It will act the same way the portal currently does. Follow the same steps you currently take to update their email/account association so they can view their new policy on the app and portal.

If a customer’s policy cancels, can they still access the app?

Canceled policies will show a banner in the app stating, “your policy is not currently active.” The policyholder will need to call Customer Care to discuss available reactivation options, but they can log into the portal infinitely after being cancelled to make payments.

What are the direct links to the app in the Apple App Store and Google Play Store?

Apple App Store: Click here!

Google Play Store: Click here!

What sets us apart from other insurance apps?

While most insurance apps offer similar functionality overall (get ID cards, make a payment, file a claim, etc.), Elephant strives to provide a superior user experience by combining ease of use with a visually sleek and modern app design. No one protects like Elephant, and we know the importance of having your coverage a click away when you need it most. Our app makes self-service more accessible and more appealing to use.

How many people can be logged in at once?

The app will really be geared towards the Named Insured however, anyone who has been given permission and provided with the email/login credentials from the NI can use the app on a different device all at the same time. It is the same for the online portal, app, portal, etc.