Setting up a Rater

Setting up a Rater |

When Elephant shows on your panel of rates, you will bridge over to our quote journey to answer a few additional questions and can bind the policy. When you transfer over your agent ID will credential behind the scenes in the transfer process. No need to create or remember any passwords for this.

If Elephant does not return a rate, this is due to them not qualifying for a quote at this time. This can be based on a number of reasons including zip code.

EZ Lynx

If you are using EZ Lynx, your agent number is your email address and there is no password. You must also select yes for the question, 'Does the agent want the applicant email to bridge to all carrier sites?'

Add carrier in EZlynx:

Add email as your username

Under the Carrier Questions tab in the Carrier Quoting Setup. Your Agent Number is your email address.

Open up a quote

On the Rating page: Make sure that Elephant is selected

On the Policy Info page: Select “yes” to bridge to all carrier sites

On the Carrier Questions page: You will use your email address for agent number. If "Email Address" shows here it's for the customer's email. You may have to unselect "Hide Prefilled Answers" to view these spaces.

For EZ Lynx support, call 877-932-2382 or email support@ezlynx.com

ITC/Turbo Rater

Once logged in to ITC TurboRater, navigate to “Admin settings” and then “Edit companies”

Add Elephant and Click “Edit Info”

When adding info for Elephant, you only need to add your “Rating User Name”, which is your email address. You keep all the other fields of producer code, sub-code and rating password blank.

For ITC/Turbo Rater support, call 866-499-9283 or email support@zywave.com

Effective Date

Effective Date |

The agent must ask/probe for and apply the correct effective date. If the customer is currently insured, the agent may probe for the effective date using an open-ended question.

- For customers who are not currently insured, select the next day as of 12:01 AM for the effective date.

- The effective date cannot be set more than 60 days in the future.

- Elephant does not backdate at new business for any reason.

- The garaging address on file must match where the NI will be keeping their vehicle when the policy goes into effect; we cannot start a policy in a new state or at a new address until they're living there.

Same Day Bind

There are only six reasons sales/service would set up a policy with a same day effective date. According to our compliance manual, here are the reasons:

- DMV-related (going to DMV to register a car, needs a SR-22 to reinstate license at DMV, etc.)

- Purchasing a new vehicle from a dealership today.

- To prevent a lapse of insurance.

- Police impounded a vehicle and require insurance to release.

- Lienholder repossessed vehicle and requires insurance to release.

- Customer is purchasing a Texas auto policy and requires insurance to get a state inspection

If the customer wants a same day bind for a reason not mentioned above, the earliest the policy can start is 12:01am the next day.

The following question must be asked by the agent prior to binding if the effective date is for the same day:

- "Have you, any drivers on your policy, or any vehicles on your policy been in any accidents today?"

If the answer is yes, you may not continue with bind.

Early Bird Discount

In order to proactively apply Early Bird, we must first make sure the customer qualifies. In order for them to qualify, they must be currently insured. They must be able to maintain their current coverage for at least 5 days or more till their policy starts with us.

The customer must PURCHASE the policy, 5 days prior to the effective date. We do not go by the quote date.

Quoting

Quoting |

**Quotes with Elephant are only guaranteed until close of business the same day. We do not honor prior quote prices.**

Quote Number

The quote number is located at the bottom of the page on the left side. See below. Having the quote number is the easiest way to retrieve the quote.

Scribe Demo

Scroll for screenshots of what the journey looks like. Click "Guide Me" for it to pop out in a second screen so you can view it while going through the journey. This shows the Bind process at the end, too.

Email or Download PDF Quote

Email or Download PDF Quote |

You can either download a PDF quote OR email an updated quote directly from the quote journey!

The new quote will include:

- Agent information - name, phone number, email and address

- Quote number

- All payment options including monthly

- Breakdown of coverage

Example Email

Example PDF Download

Retrieve A Quote

Retrieve a Quote |

If you need to come back and retrieve a quote at a later time, go to our retrieve quote page and enter your Agent ID (N# for Liberty Mutual agents and email for all other agencies) and the quote number. If you do not have the quote number you can use the customer's last name and DOB.

*Reminder: Quotes expire after 60 days and are no longer accessible. You will be required to start a new quote. *

Binding

Binding |

- Skip to step 15 in the demo to see the Binding Process (scroll down in the demo).

- Click "Ready to Buy" when the customer is ready to proceed.

- Add the driver's license number if it was not already entered.

- Verify some details about the vehicles, like if there are any hands-free features or the lienholder information.

- Incidents will show on the next page. Assign any missing drivers.

- Click whichever policy plan interests the customer. You can choose from Monthly, 2-Pay, or Pay in Full. If a payment plan does not show here, the customer may not qualify.

- Click the check mark towards the bottom of the box with the pay plans to save an extra $5 per payment by using a bank account on future installments.

- Enter the customers payment details. They can have a different payment method for future payments. The first payment must be made with a credit or debit card.

- At the bottom of the page after entering the payment details, you will choose to receive the policy documents and certify the information on the quote was true.

Binding Restrictions

Binding Restrictions |

Binding restrictions are temporary guidelines often placed ahead of major weather events intended to help minimize Elephant's loss ratio in the impacted areas.

They may prohibit policyholders from adding certain types of coverage or increasing their limits, and they may bar new policies from being bound until after the adverse weather has passed. For new business, there will be a hard stop in place so no need to keep up with zip codes etc.

While binding restrictions are active

First-party coverages are often among those that are restricted. Comprehensive, Collision, Emergency Roadside Assistance, and Rental Reimbursement all pay out to the named insured and are considered first-party.

| Policyholders MAY: | Policyholders MAY NOT: |

| Add new vehicles eff 12:01 AM next day with liability coverage ONLY* | Add new vehicles eff 12:01 AM next day with comp/coll, ERS, or RR |

| Bind new policy eff 12:01 AM next day with liability coverage ONLY* | Bind new policy eff 12:01 AM next day with comp/coll, ERS, or RR |

| Add new drivers eff 12:01 AM next day | Add comp/coll, ERS, or RR to any existing vehs on the policy |

| Lower deductibles for comp/coll on existing vehicles | |

| Increase liability limits on existing policy |

Getting Started

Free Look

Free Look |

Free Look is the period Underwriting can review new business policies for risks that were missed during the application process.

- UW runs additional reports, and then reviews previous limits, lapses/years with last insurer, and other information provided on the application.

- We can cancel a policy during the Free Look period.

- The free look period 45 days in MD, 90 days in OH, and 60 days in every other state.

If UW decides that we need to increase the premium due to information discovered during Free Look, we sent the customer an Adverse Underwriting Warning. The AUW letter is mailed as a courtesy and gives the customer a 7-days warning before the premium is increased. Once the 7 days are over, and the policyholder does not provide any proof of information against what was discovered, then an Adverse Underwriting Decision is made, and the policy is amended.

Adverse Underwriting Warning (AUW)

- Sent via email in all states

- This document is a courtesy warning emailed to policyholders to advise that there will be a change in their premium based on new information discovered by Underwriting. It will be information that conflicts with what was provided on the auto application. These are sent to the customer seven days before the change is made. Reasons for AUW:

- A policyholder's insurance history shows a lapse in coverage for any period during the past three years.

- Previous coverage limits are different than what is reported on the insurance application.

- Length of time with prior insurance is different than what was reported on the insurance application.

- Unacceptable risk.

Please note: With notice, the premium may be recalculated from the effective date of the policy as a result of an Underwriting decision, or coverage under the policy may be canceled during the free look period if your risk does not meet our Underwriting standards.

Adverse Underwriting Decision (AUD)

- Sent via mail in all states

- Mailed to the policyholder after the AUW once a change has been made to the policy based on new information discovered by Underwriting that conflicts with the information provided on the auto application.

- If a policyholder calls to correct the issue after the change has been made, their total premium can be returned to the original agreed-upon amount.

- However, if there was a down payment associated with the change, it will still apply to their next invoice, and all future invoices will be prorated to make up for the difference. Underwriting can send requests to redistribute the refund, as well as the Customer Care team leads or managers.

- In the event we need to reverse an Underwriting decision, agents do not have access to edit the previous insurance information on the Applicant page of the work order. Contact agencytechsupport@elephant.com to have the page unlocked so the information can be updated.

Additional Reports Required Pre-Bind (RCPOS)

Additional Reports Required Pre-Bind (RCPOS) |

- We’ve started running additional reports prior to bind.

- If you get this message, this is a hard stop and additional reports are required:

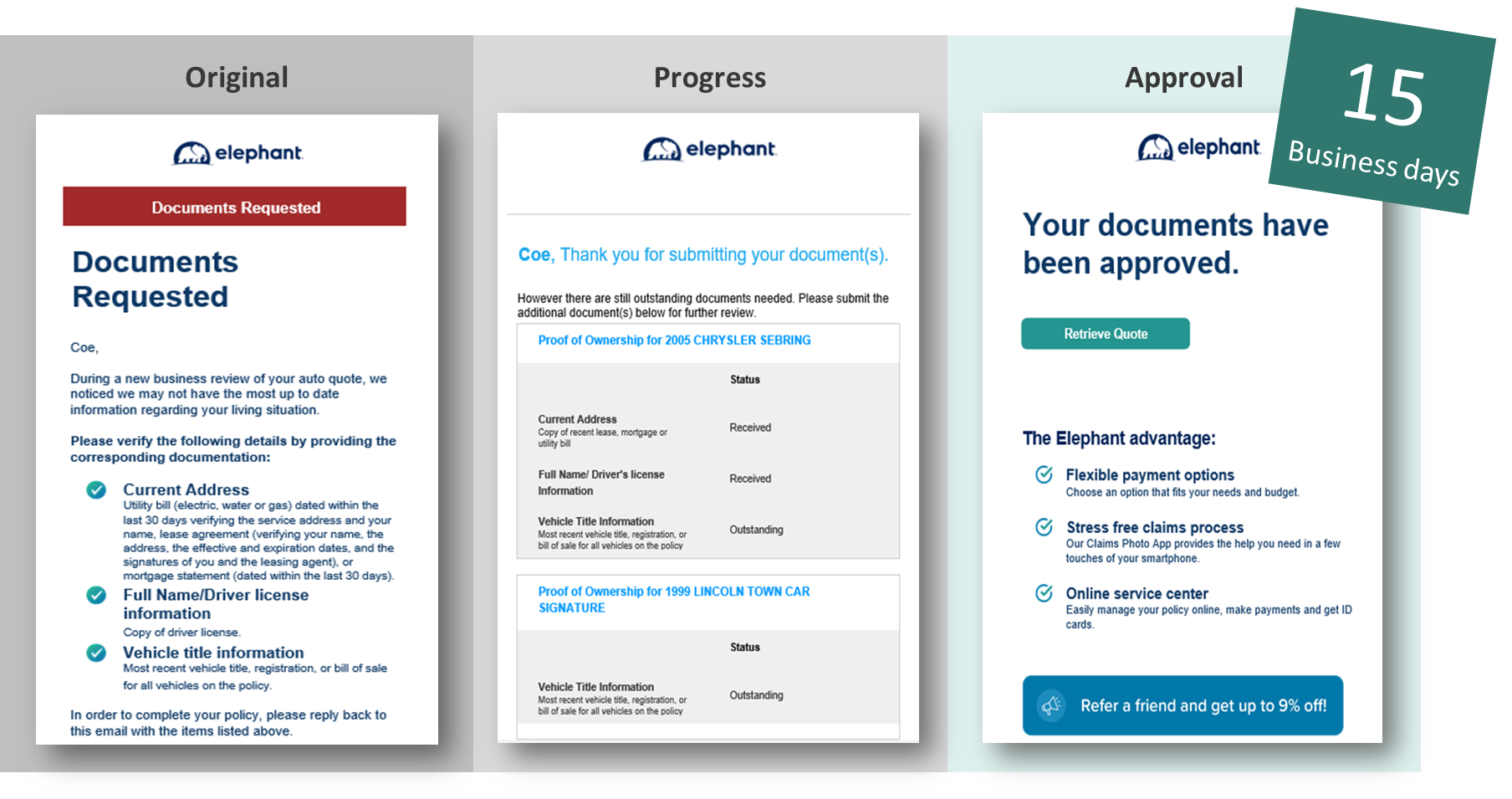

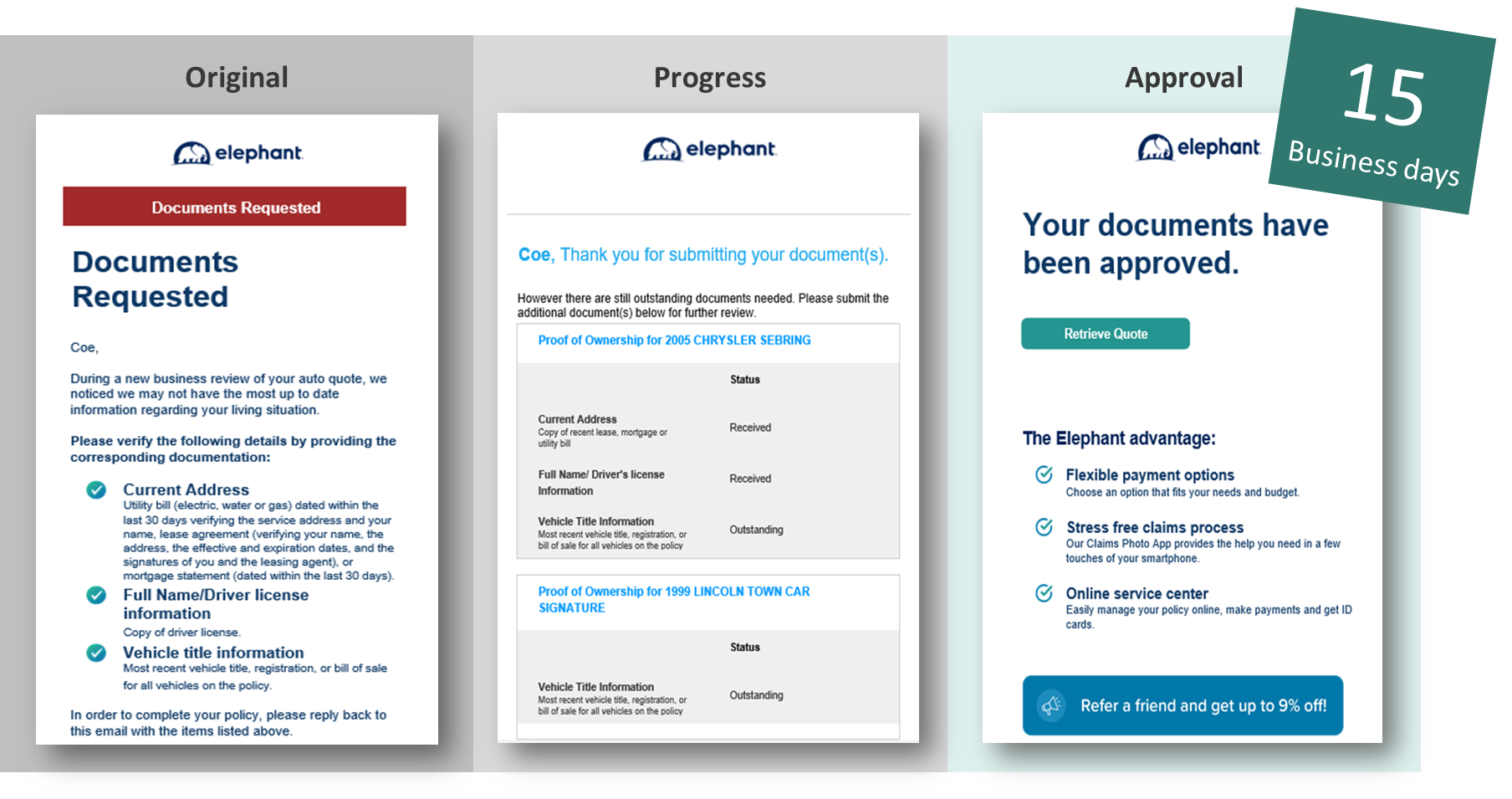

- Whatever email you enter will automatically receive an email asking for the required documents. This is what the email will look like:

- You will not be able to access the quote once you get the RCPOS message. Once you get an approval message back you will have to call in to get the finalized quote and bind.

- Documents should be sent to underwritingdocuments@elephant.com.

- Documents will be approved 15 business days (3 weeks) from when documents are received. You will receive an automatic reply once the documents are received, this is your receipt that the documents were in fact received. This process will not be expedited for any reason. There is no need to call in prior to receiving the approval email as agency support does not have access to this email. We recommend sending the documents from your email if you want to get the approval email.

- Here are examples of all related emails:

Photo Inspection

Photo Inspection |

**The photo inspection process will take 15 BUSINESS days to complete**

Depending on the information entered, Elephant may require a photo inspection. The most common reason is if there is any activity within 1 year, a photo inspection will be required. There may be other reasons you need one as well. Once the photo inspection is required you will no longer have access to the quote. After you receive the approval email you will need to work with agency support by phone, email or chat to get the quote and bind. You cannot call in to get the price until you receive an approval email. No premium will be given until the photo inspection process is complete.

**All photos should be sent to photoinspection@elephant.com. When you email Underwriting, you MUST include QUOTE # and NAME/DOB in the subject line. Not doing so may delay the process so this is extremely important.**

**Keep in mind that this activity generates after running reports so the premium you saw prior to getting the photo inspection message may change.**

Here are the steps that need to be completed:

- Please see below for instructions on how to take photos of all vehicles. There is no longer a need to call in, email or chat to initiate the process.

- When you send Underwriting the pictures, please have the quote number and name/DOB in the subject line. This will help not to have any delays with the process.

- Once the photos are sent they will receive an email in 15 business days advising if they are approved. Pictures can ONLY be reviewed by Underwriting at photoinspection@elephant.com.

- Once the approval email is received from Underwriting you can call in to get the quote and bind with Agency Support if interested. The approval email will be sent to whoever sends the photos in FYI.

Please note: Underwriting is NOT able to expedite the process nor are we able to release the quote (give a price) until Underwriting has sent the approval email. If the customer needs insurance right away or doesn't want to wait that long for a quote, Elephant is not the best fit.